Europe’s Crypto Ecosystem Faces Existential Crisis as MiCA Regulations Stifle Innovation, Report Reveals

Compliance Costs Soar 6x, 90% Job Losses, and Talent Drain Threaten EU’s Global Crypto Relevance

[Dublin, 13th of March 2025] — A stark new report by Coincub reveals Europe’s crypto sector is on the brink of collapse due to stringent regulations under the Markets in Crypto-Assets (MiCA) framework, skyrocketing compliance costs, and systemic banking barriers. The findings outline a catastrophic decline in innovation, talent retention, and venture capital investment, jeopardizing the EU’s position as a global fintech leader.Key Findings Highlight Regulatory Overreach and Compliance Costs

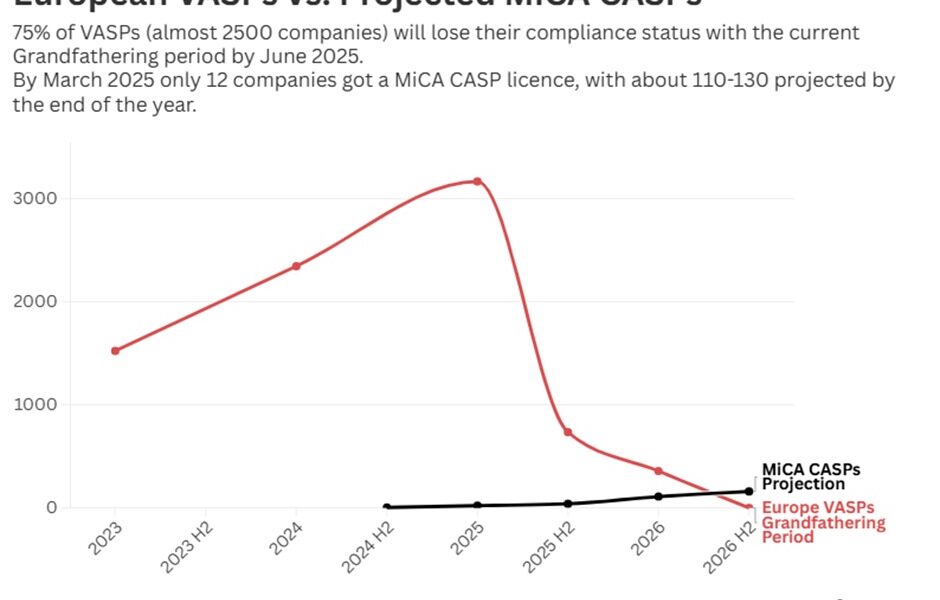

The report, Europe Crypto Report 2025, details how MiCA’s implementation has crippled the continent’s crypto ecosystem. By June 2025, 75% of Europe’s 3,167 Virtual Asset Service Providers (VASPs) will lose registration status due to unmanageable compliance burdens1. Licensing costs have surged from €10,000 pre-MiCA to over €60,000, forcing startups to relocate or shut down. Only 12 CASPs and 10 EMTs are licensed under MiCA, starkly illustrating the framework’s failure to foster innovation.

“MiCA is a nightmare for European VASPs. Most simply cannot meet the new prudential requirements, especially under Classes 2 and 3 of MiCA,” a crypto CEO stated in the report. “The cost of obtaining a license has skyrocketed due to complex procedures and expensive legal support.”

The report, Europe Crypto Report 2025, details how MiCA’s implementation has crippled the continent’s crypto ecosystem. By June 2025, 75% of Europe’s 3,167 Virtual Asset Service Providers (VASPs) will lose registration status due to unmanageable compliance burdens1. Licensing costs have surged from €10,000 pre-MiCA to over €60,000, forcing startups to relocate or shut down. Only 12 CASPs and 10 EMTs are licensed under MiCA, starkly illustrating the framework’s failure to foster innovation.

Debanking Epidemic Exacerbates Crisis

A parallel crisis unfolds as 86% of crypto startups struggle to secure bank accounts without closures, with major banks like AIB and Santander restricting services. This mirrors the U.S.’s “Choke Point 2.0” but lacks European legislative action.

Talent Drain and Job Collapse

Europe’s blockchain job market has imploded, plummeting from 100,000+ roles in 2022 to just 10,000 today—a 90% decline. Despite 600+ universities offering blockchain courses, graduates flee to the U.S., Asia,Despite 600+ universities offering blockchain courses, graduates flee to the U.S., Asia and the UAE for better opportunities. The region’s roles increasingly focus on compliance rather than innovation, contrasting with the U.S. and Asia’s emphasis on Web3 development and financial integration.

Venture Capital Dries Up

EU crypto venture funding peaked at $5.7 billion in 2022 but has since plummeted 70%, while the U.S. and Asia show recovery signs1. Investors redirect capital to regions with clearer regulatory pathways, leaving European startups starved of funds.

Call to Action for Policymakers

The report urges swift reforms:

- Streamlined licensing for smaller players to reduce barriers.

- Banking access solutions, including anti-debanking legislation.

- Capital market integration to attract global investment.

“Europe must reduce compliance burdens, simplify MiCA licensing, and enforce uniform banking rules—or risk permanent irrelevance in global crypto and Web3,” the report concludes.

About Coincub

Coincub provides leading data and reports to crypto companies, legal advisors, and policymakers. Its research combines quantitative metrics and qualitative insights to analyze emerging tech ecosystems.

Media Contact:

Dren Hima

Editor

contact@coincub.com

https://www.coincub.com

Report Source: Coincub’s Europe Crypto Report 2025.